Remember how "drill, baby drill" was supposed to lower US gasoline prices? Whoever came up with that phrase has little understanding of how oil markets work.

It's true, US crude oil production increased to an average

of 7.5 million barrels per day (bpd) in July, the highest monthly level of

production since 1991.

|

| Boom! US oil production blasts off. |

On the right side of the chart, you can see how US production is shooting higher. That output is expected to jump to 8.2

million bpd by 2014.

This oil boom has had many benefits -- on corporate profits, and on the US balance of trade, for example.

Source: Wall Street Journal

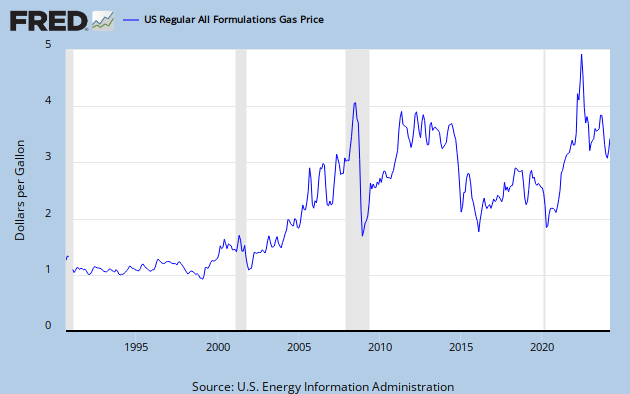

But even though American oil production is booming,

prices at the wellhead and at the gasoline pump remain high for a

number of reasons. The prices of oil and gas remain very elevated, far

higher than at any time except for the end of the 1970's and in early 2008.

In fact, you could say we’re in the Third Oil

Shock, though the mainstream media is not talking about it at all.

The price of U.S. gasoline recently dropped to

an average $3.5586 per gallon. But the fact is, it’s been stuck around $3.60

for the past two years. This is weighing

on the economy. There is little doubt that we would be seeing a much stronger

recovery if gas was priced at $1.60 or even $2.60 a gallon.

And now we have saber-rattling in the Middle East driving up oil prices again. You can bet this will translate to higher prices at the pump, at least in the near term.

So what's an average Joe investor to do? Well, you can't do much about oil prices, but you can get even by investing in stocks that should do well as the price of oil stays high. And you can also avoid companies that will be hurt by high oil prices.

This gives us an interesting array of

winners and losers.

Winners:

Select energy companies. Specifically, I would look for companies that will benefit from booming US oil production. Enbridge Energy Partners (EEP) is an example. And it recently sported a fat 7.2% dividend yield to boot.

(Updated chart)

There are many more besides EEP. Magellan (MMP) is another. Do your own due diligence, and remember you're in charge of your own investing destiny.

There are many more besides EEP. Magellan (MMP) is another. Do your own due diligence, and remember you're in charge of your own investing destiny.

Alternative energy vehicles. I'm talking about electric cars, and the push for cars that run on CNG (compressed natural gas). Also, trucks and buses that run on LNG (Liquified Natural Gas). Tesla (TSLA) is the best-known, but there are other, cheaper choices.

Traditional Auto Manufacturers. Because people trade in old gas guzzlers for more fuel efficient

vehicles.

Railroads. The cheapest of the cargo

transportation systems.

Any company that can cut down on travel expenses

– remote conferencing, etc.

Losers:

American consumers. Higher fuel prices both hit consumers in the pocketbook and constrain wages, because employers have to cut costs somewhere.

Some energy companies. For a number of

reasons, E&P companies are sold when prices are high (basically, investors

figure comparisons are going to suck going forward).

Brick-and-mortar retailers. People spend less

money on junk when they have to spend more on gasoline. They also will shop

online rather than drive to the mall. Have you noticed how we've seen big earnings misses from the likes of Gap Inc. (GAP), Abercrombie & Fitch (ANF), Staples (SPLS) and Dick's Sporting Goods (DKS). Other companies that lowered earnings in just the past week include Bon-Ton Stores (BONT), Ross Stores (ROSS) and Anny Taylor (ANN). It's a brick-and-mortar retail massacre!

Good luck to us all, and good trades.

Sean

No comments:

Post a Comment