1. In the short run, the market is a voting machine, but in the long run, it is a weighing machine.Dividend yields and earnings growth drive stock returns. And that's the bottom line.

2. India's economic crisis is getting worse. And check out the plunge in India's currency, the Rupee. The words "market panic" are being used more frequently. My take: This has big implications for the world's agriculture, energy and precious metals markets. I'll write more about this another time.

3. Meanwhile, India may buy gold from ordinary citizens and send it to smelters, in a bid to cut down on gold imports. It's an interesting, even off-the-wall plan. But they've tried everything else. Why not?

4. No surprise, but worth reading: How an insular beltway elite makes wars of choice more likely. And here's a prime example of your "liberal media" right here. Finally, events are moving quickly in Syria, so here's what you need to know. My take: One can hope for a quick and bloodless resolution to the Syrian situation, but one must also be ready for oil to ramp up to $120 if things get really bad. That's the problem -- all this volatility makes investing difficult. Traders, on the other hand, are having a field day.

5. Nice chart: Where the Middle-Class Jobs Are Vanishing the Fastest

More on employment -- the decline in unemployment since the recession is almost entirely due to a contraction in the number of Americans participating in the labor force. Some good charts at that link, including this one:

6. There are now more electric cars than there are gas stations. Or in raw numbers, approximately 120,000 electric cars versus 117,000 gas stations.

7. Q2 GDP Revised up to 2.5%, Weekly Initial Unemployment Claims decline to 331,000

Both of these numbers were better than expected. See also, The Future Is Still Bright.

Interestingly, while 2nd quarter GDP was revised higher, once again state and federal contributions to GDP were revised lower, and both were outright negative. My take: the economy would be doing better except for the drag of REDUCED government spending. That's something to think about. But the only spending the current Congress likes -- apart from their fatcat salaries and benefits -- is war spending. Maybe we'll get some of that soon, eh?

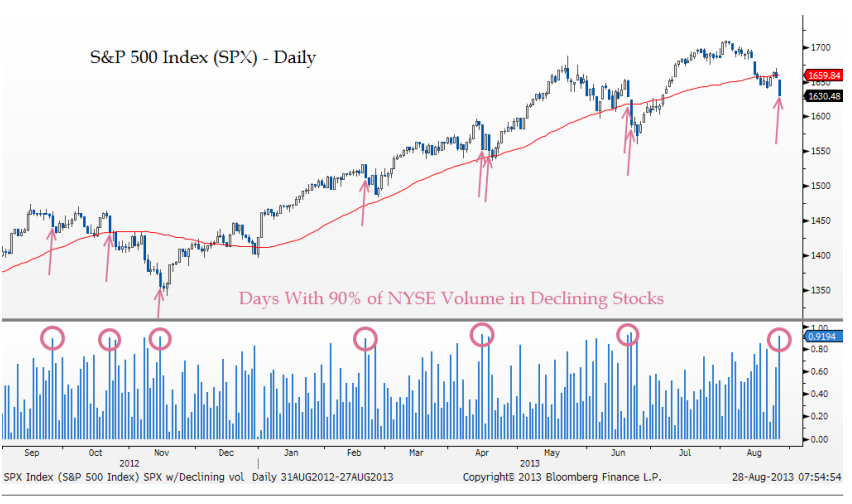

8. Are we close to the end of a correction? The Reformed Broker thinks so. 90% down days (in which 90% or more of volume on the exchange is in declining stocks), which we recently had, tend to come at the end of a correction. He offers this chart, which he picked up from the fine folks at Miller Tabak ...

9. September is a seasonally strong month for gold as jewelers buy ahead of the upcoming major holidays around the world. What's more, while gold has risen 20% since the June low, it also remains well down from the 2011 peak and has only recouped around half of the decline from the high of 2013 to the low. Still, regularity breeds complacency, and if you're complacent in this market, you're a bloody fool.

10. Laugh for the day. For parents everywhere ..

Have a great Thursday. Be careful out there.

No comments:

Post a Comment