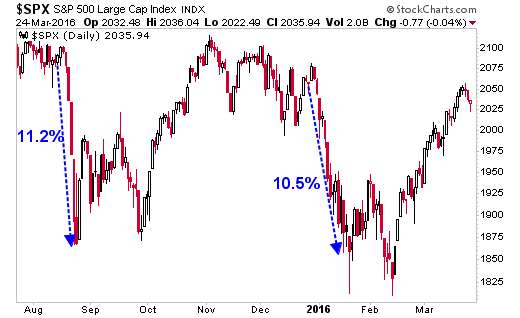

(Updated chart)

Naturally, the question becomes: Is history about to repeat itself? Is the S&P 500 in a big, ranging market?

Some developments that add to the bear case:

Fed officials back talking about rate hikes again -- this time in April -- after blinking at the March FOMC meeting AND lowerign their forecast for the number of rate hikes this year.

Also, as the Wall Street Journal tells us, "Corporate profits after tax, without inventory valuation and capital consumption adjustments, fell at an 8.1% pace last quarter from the third. That was largest quarterly decline since the first quarter of 2011. Profits fell 3.3% in third quarter from the second. On a year-over-year basis, corporate profits declined 3.6% in the fourth quarter."

U.S. GDP growth came in at 1.4% in the fourth quarter. That's pretty anemic, but it also might be the new normal.

One more chart. This is of forward S&P 500 earnings.

Is the S&P 500 overpriced? I don't know. But it's certainly not cheap.

Don't worry too much about this over the weekend. Have a wonderful Easter.

No comments:

Post a Comment