Link #1: Thanks to falling oil prices, Europe's trade surplus is booming!

Link #2: US Oil Prices Tank on surge in US supply, imports

The U.S. is awash in oil,

with record levels of production meeting a rising tide of imports. The

U.S. Department of Energy said oil stocks rose by 7.26 million barrels,

while analysts had expected a decline of 1.8 million barrels.

"Refiners produced the highest amount of gasoline ever reported by the EIA — 9.92 million barrels per day," noted Andrew Lipow, president of Lipow Oil Associates. He said refiners produced the second-highest amount of distillate fuel ever, at 5.24 million barrels per day, second only to 5.26 million barrels a day in December 2013.

Refineries were also running at a high rate, with utilization at 93.5 percent. "To be able to build crude inventories like that in the face of a 93.5 percent utilization rate is remarkable. Imports are also rebounding," said John Kilduff of Again Capital. He said imports of crude rose to 8.3 million barrels per day from 7.1 million the previous week.

Link #3: Saudi Arabia projects huge deficit as oil price drop bites

The government announced the $38.6 billion deficit on state-run television, saying it would nonetheless boost projected spending by tapping its vast financial reserves.

The 2015 budget shortfall is the first deficit projected by the OPEC kingpin since 2011 and the largest ever for the kingdom.

The price of oil, which makes up around 90 percent of public income in Saudi Arabia, has lost about half of its value since June due to a production glut, weak global demand and a stronger US dollar.

If oil prices remain at the current level of about $60 a barrel for benchmark Brent crude, Saudi Arabia is expected to lose half of its oil revenues of $276 billion posted in 2013. Oil income this year is expected at $248 billion.

But the wealthy kingdom, which pumps about 9.6 million barrels per day, can easily tap into huge fiscal buffers, estimated at $750 billion, to meet the deficit.

Link #4: Oil’s Swift Fall Raises Fortunes of U.S. Abroad

A plunge in oil prices has sent tremors through the global political and economic order, setting off an abrupt shift in fortunes that has bolstered the interests of the United States and pushed several big oil-exporting nations — particularly those hostile to the West, like Russia, Iran and Venezuela — to the brink of financial crisis.

The price plunge may also influence Iran’s deliberations over whether to agree to a deal on its nuclear program with the West; force the oil-rich nations of the Middle East to reassess their role in managing global supply; and give a boost to the economies of the biggest oil-consuming nations, notably the United States and China.

It might even have been a late factor in Cuba’s decision to seal a rapprochement with Washington.

For Iran, which is estimated to be losing $1 billion a month because of the fall, it is as if Congress had passed the much tougher sanctions that the White House lobbied against

Link #5: Commodity Supercycle Could Be Over Says Deutsche Bank

The ten year-old commodity supercycle, triggered by rising demand in booming emerging markets, “has come to a clear and abrupt end” as the price of oil has been halved, a report from Deutsche Banks says. While other commodities have been heading south for some time, it is the fall in the price of oil, however, that appears to be sealing a sea change in thought regarding the end of the commodity supercycle.

The report from Josef Auer and Lorenz Vignold-Majal, notes that the Commodity Price Indices compiled by Germany’s Hamburg Institute of International Economics (HWWI) have reached their lowest levels since 2010, leading to a trend lower in commodity prices. Moderate global growth from 2012 to 2014, the bank noted, is “no doubt one of the main reasons, and perhaps the most important one, for the trend.”

To read the whole report, click here.

Link #6: 10 Economic Questions for 2015

1) Economic growth: Heading into 2015, most analysts are pretty sanguine. Even with contraction in Q1, 2014 was a decent year (GDP will grow around 2.4% in 2014). Will 2015 be the best year of the recovery so far? Could 2015 be the best year since the '90s? Or will 2015 disappoint again?

2) Employment: With one month to go, 2014 is already the best year for employment growth since the '90s. Will 2015 be as strong? Or will job creation slow in 2015?

3) Unemployment Rate: The unemployment rate was at 5.8% in November, down 1.2 percentage points year-over-year. Currently the FOMC is forecasting the unemployment rate will be in the 5.2% to 5.3% range next December. What will the unemployment rate be in December 2014?

Read the rest.

By the way, U.S. vehicle sales saw their strongest December in 10 years, weekly initial unemployment claims decreased to 280,000, mortgage applications are increasing, and personal income and spending are increasing.

In fact, thanks to cheap oil, consumer spending is blasting off.

More by the way, the S&P 500 is up 12.6% year-to-date as I write this. In the past four years, it's up 65%!

(Updated chart)

And most indications are that the S&P 500 is about to take another leg up.

Do tell me again how President Obama is a socialist who creates a negative business environment.

Anyway, have a Merry Christmas. I'll talk to you next week.

"In the Valley of the Blind, the One-Eyed Man Is King." Market charts, analysis and links

Thursday, December 25, 2014

Monday, December 22, 2014

Upcoming interview on Energy

On Wednesday, I'll be interviewed at 2 pm Eastern Time on Arise News (www.arise.tv), a cable news station in New York. In preparation, here are four stories I've written on energy recently.

“Three

Pitfalls for Energy in 2015”

Nice

Oil Cartel You Got There. Be a Shame if Something Happened to It

What

Most People Don’t Get About Crude Oil

Thursday, December 18, 2014

Fascinating Chart Action on Dollar and Gold

I find the chart action in the US dollar (as tracked by the UUP fund) and gold (as tracked by GLD) fascinating. I'm kind of a geek that way, but see if you find it interesting.

(Updated chart)

Here's the thing. We can all see the U.S. dollar looks poised to go to new highs. That should happen, unless emerging markets like Russia make a miraculous recovery, Japan finds a recovery concealed in its kimono and Europe finds that recent deflation is all just a bad dream.

However, while the dollar pushes to new highs, gold is off its lows. It hasn't even tested low it made back in November. How do you like them apples? What does it mean? Hmm...

(Updated chart)

Here's the thing. We can all see the U.S. dollar looks poised to go to new highs. That should happen, unless emerging markets like Russia make a miraculous recovery, Japan finds a recovery concealed in its kimono and Europe finds that recent deflation is all just a bad dream.

However, while the dollar pushes to new highs, gold is off its lows. It hasn't even tested low it made back in November. How do you like them apples? What does it mean? Hmm...

Wednesday, December 17, 2014

Waiting on Janet

The market is waiting on the Fed. The big question is, how will the week end, and will the recent

blood-letting in the markets finally end.

Today, the Federal Reserve issues its latest policy

statement at 2 pm. Wall Street will be holding its breath, waiting to see if

the Fed changes language saying it will keep interest rates close to zero for a

“considerable time” even after its bond-buying stimulus measures have ended.

Remember, reactions to Fed-Speak can be short-term. Longer-term, we need to look at the

background economy, and what that potentially means for profits and prices.

Oil

Could Go Lower

This week, the United Arab Emirates’ energy minister said

OPEC will stand by its decision not to cut output even if oil prices fall as

low as $40 a barrel. What’s more, OPEC will wait at least three months before

considering an emergency meeting.

To be sure, Suhail Al-Mazrouei was talking about the

international oil benchmark, Brent Crude.

Since West Texas Intermediate (the U.S. benchmark) usually trades at a

discount to Brent, prices could be lower here. Yikes!

On December 12, Free Market Café published my article

titled, “Three

Pitfalls for Energy in 2015.” I lay out some other forces that

could push prices lower.

Now for the good news.

·

It won’t be a straight line. We’ll see

rallies and plateaus along the way.

·

Also, energy stocks will probably bottom

long before the price of energy.

·

Finally, the market is punishing

companies that primarily produce natural gas along with oil producers. But the

outlook for some nat-gas producers, transporters, pipeline companies and so on

is quite good. That’s a disconnect we can take advantage of.

And don’t write off oil, either. There are some pipeline

companies and transporters that can continue

to do well.

Economic

Outlook

The oil price drop stoked fears of major dislocations across

asset classes. The fear is we could see a worsening emerging market currency

crisis or maybe junk debt collapse. I’m not saying that will happen, just that

Wall Street is worrying, even obsessing, about these perils now.

And sure, we are seeing weakness in Europe, where deflation

fears are raising their ugly head. China’s manufacturing is slowing down, too.

In other words, investors worry about a global recession. That’s

why foreign investors are piling into U.S. Treasuries at the fastest pace in

two years.

On the other hand, U.S. economic news continues to be good,

unless you’re in the oil business. Retail sales rose 0.6% in November after

rising 0.5% in October. U.S. manufacturing surged last month, with the largest

increase in 9 months. Wow!

Sure, maybe the U.S. is “the best house on a bad block.” Or

maybe lower oil prices are fuel for a global economic boom that isn’t

recognized yet.

Monday, December 15, 2014

Looking for Santa -- What Did the Market Do Last Year?

Traders are looking for a Santa Claus rally, but not finding one, at least so far. What happened last year? Let's look at this chart of the S&P 500 from late 2013 through the early months of 2014.

Stocks actually sold off from late November through December 17, a peak-to-trough loss of 2.3%. Then the markets did experience a Santa Claus rally of about 4.5%. That ended in January for another 6% loss. And this was followed by a trough-to-peak rally of 8.3%.

Santa did show up. But he was riding a roller coaster.

Stocks actually sold off from late November through December 17, a peak-to-trough loss of 2.3%. Then the markets did experience a Santa Claus rally of about 4.5%. That ended in January for another 6% loss. And this was followed by a trough-to-peak rally of 8.3%.

Santa did show up. But he was riding a roller coaster.

Friday, December 12, 2014

How Low Could The S&P 500 Go?

What if there's no Santa Claus rally this year? That's what investors are asking themselves as they watch the market bleed lower on what should be good news.

For the record, I'm in the camp thinking there WILL be a Santa Claus rally. History is on the side of that.

However, there is a possibility we could see the same kind of pullback we saw in October, when the S&P 500 pulled back more than 9% (on an intraday basis) before heading higher again

Take a look at this chart ...

(Updated chart)

The lines I have put on this chart are as follows ...

The economic news and consumer sentiment keep getting better and better. Stocks can go lower, though, if investors are worried about profits. Considering that consumers make up a much bigger part of the economy than energy stocks, investor's shouldn't be worried. But the difference between shouldn't and aren't, to paraphrase Mark Twain, is the difference between lightning and a lightning bug.

Anyway, who am I to stand in the way of anyone's panic? It just brings us to cheaper prices for the next rally.

Have a great weekend.

For the record, I'm in the camp thinking there WILL be a Santa Claus rally. History is on the side of that.

However, there is a possibility we could see the same kind of pullback we saw in October, when the S&P 500 pulled back more than 9% (on an intraday basis) before heading higher again

Take a look at this chart ...

(Updated chart)

The lines I have put on this chart are as follows ...

- The 50-day moving average and 200-day moving averages are self-explanatory.

- 1950 is a 50% Fibonacci pullback.

- 1918 is a 61.8% Fib pullback.

- 1880 would be the same percentage decline as we saw (intraday) in October.

The economic news and consumer sentiment keep getting better and better. Stocks can go lower, though, if investors are worried about profits. Considering that consumers make up a much bigger part of the economy than energy stocks, investor's shouldn't be worried. But the difference between shouldn't and aren't, to paraphrase Mark Twain, is the difference between lightning and a lightning bug.

Anyway, who am I to stand in the way of anyone's panic? It just brings us to cheaper prices for the next rally.

Have a great weekend.

Thursday, December 11, 2014

What Most People Don't Get About Crude Oil

Oil prices fell 4.9% yesterday (West Texas Intermediate crude price).

The conventional wisdom is that as oil prices fall, producers will trim high-cost oil production, and we'll hit some new equilibrium.

Here's the thing that most people don't get: Producers have bills to pay. I don't care whether you're talking about some Kuwaiti oil sheik or some Texas wildcatter, they all got bills to pay.

Those bills have to be paid with income. Let's say your source of income is oil. The price of oil goes down. How are you going to pay those bills?

The simplest thing to do is PUMP MORE OIL.

The less money you make on every barrel of oil, the more barrels you have to pump to get anywhere close to the money you need to pay your bills.

See where this is leading?

Let me give you an example.

Goodrich Petroleum (GDP) has already said that its capital spending (exploration) will drop nearly 50% in 2015 given the drop in prices. At the same time, Goodrich expects its output will increase 30% to 40%.

So, if we are expecting shut-ins of production to help the oil price, it likely won’t happen near term.

My target on oil was $60. We've reached that. That doesn't mean we have to bounce here. Sure, oil is oversold. But there are easier ways to make money right now than in the energy markets.

The conventional wisdom is that as oil prices fall, producers will trim high-cost oil production, and we'll hit some new equilibrium.

Here's the thing that most people don't get: Producers have bills to pay. I don't care whether you're talking about some Kuwaiti oil sheik or some Texas wildcatter, they all got bills to pay.

Those bills have to be paid with income. Let's say your source of income is oil. The price of oil goes down. How are you going to pay those bills?

The simplest thing to do is PUMP MORE OIL.

The less money you make on every barrel of oil, the more barrels you have to pump to get anywhere close to the money you need to pay your bills.

See where this is leading?

Let me give you an example.

Goodrich Petroleum (GDP) has already said that its capital spending (exploration) will drop nearly 50% in 2015 given the drop in prices. At the same time, Goodrich expects its output will increase 30% to 40%.

So, if we are expecting shut-ins of production to help the oil price, it likely won’t happen near term.

My target on oil was $60. We've reached that. That doesn't mean we have to bounce here. Sure, oil is oversold. But there are easier ways to make money right now than in the energy markets.

Friday, December 5, 2014

Friday Wrap -- Jobs and Oil (Big Charts!)

First of all, here is the most important paragraph you will read all week:

“Those who travel with the current will always feel they are good swimmers; those who swim against the current may never realize they are better swimmers than they imagine.” (source)Chew on that for a minute. Now, on to some economic-market analysis.

The employment news is excellent.

- US employers hired 321,000 people last month.

- This was the strongest month of hiring since January 2012 – almost two years ago.

- We’re on track for the best year of job creation in 15 years.

- Average hourly earnings rose 0.4 percent, the most since June of last year.

Here is one chart you should see ...

That chart shows the jobs being created are full-time jobs. Those are the kind of jobs we want.

What you can take away from all this is ... well, you know those people who have been telling you that you should sit out this rally because the economy is in the tank? Those people are lying to you.

Let's talk about energy.

There are those who say falling oil prices will hurt the U.S. economy. They're as full of sh*t as the people who have been ranting that the U.S. economy is in the tank despite rising payrolls.

Here is what you need to know:

Consumer spending represents 68% of the US economy. Oil and gas capex represents about 1% of US GDP and less than 9% of US total capex (which in turn represents about 12% of US GDP). Therefore, the benefit of lower energy prices to the consumer and many businesses greatly outweighs the significant hit to energy companies and/or energy-oriented capex, especially in energy-oriented states.

Got that? That doesn't mean there won't be layoffs in the oil patch. Of course there will be. But the oil patch has seen booms and busts before, and it's a buying opportunity for investors with a longer-term view.

Now that we have that settled, let's look at what should affect oil prices in the short-term.

First, the Saudis keep cutting oil prices. They aren't blinking in this price war. They think they can win.

US Global Investors says the price of oil is getting near the Saudi break-even price.

Is US Global right? Ask the Saudis.

U.S. producers aren't blinking either. Meanwhile, here's what we know about breakeven prices in some U.S. shale plays and the oil sands (source)...

And new U.S. oil and gas well permits dropped 40% in November.

Just five days after the Organization of Petroleum Exporting Countries decided to maintain production levels, Iraq, the group’s second-biggest member, made a deal that may add about 300,000 barrels per day (bpd) to world supplies.

And new production is starting in the U.S. Gulf of Mexico. Read this next piece of an eye-opener:

On Tuesday, U.S. major Chevron Corp. and its consortium partners announced crude oil production started at the Jack/St. Malo project in the deep waters of the U.S. Gulf of Mexico, one of the region's largest. "The Jack/St. Malo project delivers valuable new production and supports our plan to reach 3.1 million barrels per day by 2017," George Kirkland, vice chairman and executive vice president for upstream operations at Chevron, said in a statement. If realized, that would be roughly three times the current rate of production from the Bakken shale oil field in North Dakota.

Remember, there is already a surplus of between 1 million bpd and 2 million bpd on the global oil market.

On Wednesday, when U.S. crude oil prices bounced, Bill O’Grady, chief market strategist at Confluence Investment Management in St. Louis, which oversees $2.4 billion said in press reports: “We’re in a bear market so every move higher will be limited. Every rally is an opportunity to get out of long positions and load up on shorts.”

In Oklahoma City, gasoline prices dipped below $2 a gallon.

That's promotional, sure, but the big trend at the gas pump is lower.

Still, that doesn't mean the Doomers don't have plenty to gloom about.

Have a great weekend.

Tuesday, December 2, 2014

Where Will Small-Caps Go From Here? (IWM)

Small-caps could be poised for a deeper pullback in the short-term, as we can see from this chart of the Russell 2000 iShares (IWM). A lot depends on what happens today, so stay tuned.

Here's the scoop: On Friday, the IWM tagged the top of its recent Bollinger Band and pulled back.

On Monday, it gapped lower and tagged the bottom of the Bollinger Band.

So, trading range, right? Except that short-term momentum appears to be weakening. Therefore, it wouldn't surprise me to see 113 or 111 tested. Even 109.60 could be tested within the context of a larger bull move.

(Updated chart)

For the bigger picture, let's look at a weekly chart of the IWM.

(Updated chart)

You can see that the IWM has been rangebound all year while consolidating last year's rally. Such horizontal consolidation is usually a continuation move, and we'll look for a breakout in the direction of the previous rally. MACD gave a "buy" signal in November.

So, let's see where the short-term pullback takes us. It will be short-term pain for existing positions. But it also may be a great buying opportunity.

Some other news worth reading

Pullback, Sure. But Odds of a Large Loss in December Are Low: http://fat-pitch.blogspot.com/2014/12/low-odds-of-big-fall-in-december.html?spref=tw …

Source: @ukarlewitz

Silver's largest intraday move in two years: http://ln.is/www.marketwatch.com/Xw5a0 …

There's No Telling What This Oil Slide Could Do To Junk Bonds: http://t.co/A1xna51u7Lhttp://t.co/A1xna51u7L

It might not feel like it, but the US #economy grew at a healthy 3.9% pace last quarter: http://t.co/1jyw0QecLN

Here's the scoop: On Friday, the IWM tagged the top of its recent Bollinger Band and pulled back.

On Monday, it gapped lower and tagged the bottom of the Bollinger Band.

So, trading range, right? Except that short-term momentum appears to be weakening. Therefore, it wouldn't surprise me to see 113 or 111 tested. Even 109.60 could be tested within the context of a larger bull move.

(Updated chart)

For the bigger picture, let's look at a weekly chart of the IWM.

(Updated chart)

You can see that the IWM has been rangebound all year while consolidating last year's rally. Such horizontal consolidation is usually a continuation move, and we'll look for a breakout in the direction of the previous rally. MACD gave a "buy" signal in November.

So, let's see where the short-term pullback takes us. It will be short-term pain for existing positions. But it also may be a great buying opportunity.

Some other news worth reading

Pullback, Sure. But Odds of a Large Loss in December Are Low: http://fat-pitch.blogspot.com/2014/12/low-odds-of-big-fall-in-december.html?spref=tw …

Source: @ukarlewitz

Silver's largest intraday move in two years: http://ln.is/www.marketwatch.com/Xw5a0 …

There's No Telling What This Oil Slide Could Do To Junk Bonds: http://t.co/A1xna51u7Lhttp://t.co/A1xna51u7L

It might not feel like it, but the US #economy grew at a healthy 3.9% pace last quarter: http://t.co/1jyw0QecLN

Monday, December 1, 2014

Chart of the Day -- A Grinch Before Christmas

Here's a chart showing how markets perform around Thanksgiving.

Source

We saw the big sell-off after Thanksgiving. If markets go true to form, the S&P 500 will close fairly flat today. And the whole week should be pretty miserable.

The Stock Traders' Almanac HAS MORE.

Better luck next week. And the Santa Claus rally is a thing, so stay tuned for that.

Source

We saw the big sell-off after Thanksgiving. If markets go true to form, the S&P 500 will close fairly flat today. And the whole week should be pretty miserable.

The Stock Traders' Almanac HAS MORE.

Better luck next week. And the Santa Claus rally is a thing, so stay tuned for that.

Friday, November 28, 2014

Must-See Oil Charts & News

The big story is that OPEC basically did nothing at its meeting.

“We will produce 30 million barrels a day for the next 6 months, and we will watch to see how the market behaves,” OPEC Secretary-General Abdalla El-Badri told reporters in Vienna.And OPEC is doing nothing for a good reason. If OPEC cuts production, it actually helps the North American oil producers they are competing against.

"OPEC has relinquished the role of balancing the market. If they had cut production and prices had increased then they would, by definition, be losing market share. They would be encouraging and supporting further shale production. For them, short-term pain for long-term gain.”

The nail in the coffin had to be that Russia ruled out a deal on a production cut with OPEC. Nobody loses more from low oil prices than Russia.

This sent oil plunging, as you can see from this chart ...

This sent oil plunging, as you can see from this chart ...

In fact, oil is on its way to its biggest weekly drop in three years.

So who is vulnerable? This chart is from last year, and new technology is lowering the costs in the shale fields all the time. However, here are some likely suspects for pain ...

And here is a chart from Citigroup showing the average cost of US shale oil plays.

And if you follow THIS LINK you can see a (very busy) chart purporting to show the break-even cost of every drill project in the world.

How about individual companies?

Here is a list of 10 US shale oil stocks getting crushed the most on Friday's shortened trading day.

And who are the winners? Well, as subscribers to my $10 Trigger Alert know, I like airlines as a winner from lower oil prices. And sure enough, airline stocks are flying high on Friday.

Will OPEC's hard-line stance have the effect it wants? So far, estimates of US production aren't falling yet.

Some other news of interest...

So who is vulnerable? This chart is from last year, and new technology is lowering the costs in the shale fields all the time. However, here are some likely suspects for pain ...

And here is a chart from Citigroup showing the average cost of US shale oil plays.

And if you follow THIS LINK you can see a (very busy) chart purporting to show the break-even cost of every drill project in the world.

How about individual companies?

Here is a list of 10 US shale oil stocks getting crushed the most on Friday's shortened trading day.

And who are the winners? Well, as subscribers to my $10 Trigger Alert know, I like airlines as a winner from lower oil prices. And sure enough, airline stocks are flying high on Friday.

Will OPEC's hard-line stance have the effect it wants? So far, estimates of US production aren't falling yet.

U.S. oil production has risen to 9.077 million barrels a day, the highest level in weekly data from the Energy Information Administration going back to 1983. Output will climb to 9.4 million next year, the most since 1972.For investors already holding oil stocks, there’s no question that Friday will be a terrible day. But this is also a time for investors to begin considering the long-term opportunity once oil prices bottom.

Some other news of interest...

- Copper Falls to 4-Year Low as Oil Tumble Drives a Slump. In other words, we could see pain spread through the commodities sector. It's not just copper, either.

- And iron ore is tumbling, too.

- The falling price of oil is hitting Sasol as well.

- Also, the Eurozone is in real trouble

Tuesday, November 25, 2014

Let's Look at that IWM (Small-Caps) chart again

In early November, I posted a chart of the Russell 2000 iShares (IWM), talking about how MACD on the weekly chart was giving a big ol' buy signal. This, combined with seasonal factors, mean it was a really smart time to go long small-caps.

Let's see how that worked out.

(Updated chart)

Lookin' good so far. Stay the course, my friends.

Let's see how that worked out.

(Updated chart)

Lookin' good so far. Stay the course, my friends.

Small-Caps & Micro-Caps Start to Play Catch-Up

Here's a chart you'll probably find interesting. As you can see, the major indices have all posted similar gains in the past month. But starting on November 19th, small-caps and micro-caps started to accelerate.

(Updated chart)

This is probably the start of the Santa Claus rally, which, like Mall Christmas decorations, seems to come earlier every year. And what comes next? The January Effect! I recently wrote an article about that for the Free Market Cafe's Daily Grind. You can read that HERE.

See also: The current market rally is well below average in both duration and magnitude. Via Chart of the Day

(Updated chart)

This is probably the start of the Santa Claus rally, which, like Mall Christmas decorations, seems to come earlier every year. And what comes next? The January Effect! I recently wrote an article about that for the Free Market Cafe's Daily Grind. You can read that HERE.

See also: The current market rally is well below average in both duration and magnitude. Via Chart of the Day

Monday, November 24, 2014

Chart of the day: Beer, Beer, BEER!

Americans Now Drink More Craft Beer Than Budweiser.

That is NOT including Bud Light. Just Budweiser.

Read the whole story HERE.

US stocks tend to outperform stocks in the rest of the world when the dollar is strong.

Just remember that a stronger dollar will weigh on S&P 500 earnings. And read the rest of the story HERE.

And this chart of U.S. crude oil production is being called "The Chart of the Year."

"The most important reason why oil prices are falling is because of the dramatic increase in recent years in US crude oil production ... and US oil production is expected to increase further by 1 mmb/d in 2015 and 0.6-0.7 mmb/d per year in the years to 2020. In other words, expect a continued increase in oil supply going forward."

Read the rest HERE.

One more thing: The always excellent Phil Flynn says that the world is oversupplied by 2 million barrels a day, so even if OPEC cuts by 1 million bpd on Thursday, it may not make a dent in the global oil glut

That is NOT including Bud Light. Just Budweiser.

Read the whole story HERE.

US stocks tend to outperform stocks in the rest of the world when the dollar is strong.

Just remember that a stronger dollar will weigh on S&P 500 earnings. And read the rest of the story HERE.

And this chart of U.S. crude oil production is being called "The Chart of the Year."

"The most important reason why oil prices are falling is because of the dramatic increase in recent years in US crude oil production ... and US oil production is expected to increase further by 1 mmb/d in 2015 and 0.6-0.7 mmb/d per year in the years to 2020. In other words, expect a continued increase in oil supply going forward."

Read the rest HERE.

One more thing: The always excellent Phil Flynn says that the world is oversupplied by 2 million barrels a day, so even if OPEC cuts by 1 million bpd on Thursday, it may not make a dent in the global oil glut

Wednesday, November 19, 2014

Small-Caps Weaken, Consumer Goods Pick Up

Check out this chart from StockCharts.com for $RUT

I'm waiting for the usual December end-of-year outperformance in small-caps. However, that group peaked on November 12th and has underperformed both the Dow and the S&P ever since.

When it comes to industries, healthcare is outperforming. Consumer good are just starting to turn up.

I'm waiting for the usual December end-of-year outperformance in small-caps. However, that group peaked on November 12th and has underperformed both the Dow and the S&P ever since.

When it comes to industries, healthcare is outperforming. Consumer good are just starting to turn up.

Thursday, November 13, 2014

2 Charts on Gold & 1 Kick-Ass Song

You'll notice that I am not blogging as much as I used to. That's because I have new projects that are consuming my time. And when it comes to writing things for fun (like this blog) or for money (my other writing) then money usually wins out. I have a wife and 2 kids.

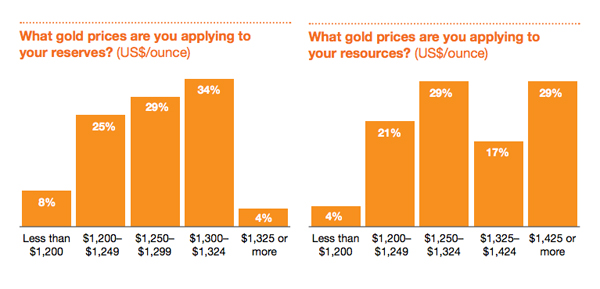

Despite this pessimism however, gold miner's longer term assumptions assume a strong recovery in the gold price from today's levels.

When asked what gold price companies are using to determine reserves, the average among respondents was $1,241 per ounce, with a range of between $950 and $1,350. For resources, the average was $1,331 per ounce with a range of between $950 and $1,600.

Note: I have a an interview HERE where I talk about the future haircuts miners are going to have to take, among other things, if the price of gold doesn't go higher soon.

#2: India Back to Being World's Top Gold Consumer

India reclaimed its world’s top gold consumer crown from China as demand for jewelry surged almost 60% in the third quarter of the year, fresh data from the World Gold Council (WGC) shows.

Global demand, however, fell to its lowest in nearly five years as Chinese buying slid by a third and gold jewellery, the biggest single area of consumption, dropped 4% to 534 tonnes.

Overall, India —which had lost his position as the world’s No.1 gold consumer to China in 2011—bought 39% more gold in the run-up to Diwali and the start of the traditional wedding season.

Gold smuggling into India has skyrocketed since the government ratcheted up restrictions and taxes on legitimate imports of the precious metal. According to the council, about 200 tons of gold came through unofficial route last year and a similar quantity is also expected this year.

Note: See how they buried the bad news in the second paragraph? World gold demand has dropped to its lowest level in 5 years. Fu-u-u-u-u-u-u ....

#3. Gold Chart Sure Looks Like It's Going Lower

I made this chart of the GLD, which tracks the percentage movements in gold pretty closely, on Stockcharts this morning. No one has a crystal ball. But it sure looks like gold is consolidating after a breakdown. Such consolidation usually resolves in the direction of the previous move.

How much lower? If you liked gold at, say, $1,000, you're probably going to get a chance to love it again.

I would love to be wrong on this, by the way. By all means, feel free to show me up so bad I make Dennis Gartman look good.

That said, there are plenty other places to make money. I'll give you one example. The fact that oil is folding like an old tent means a lot of opportunities to make money. That's what we're doing in $10 Trigger Alert. And we've also positioned for it in Oxford Resource Explorer. And those picks are doing quite splendidly.

Also remember that nothing goes down forever. Have money ready when the bottom comes.

Anyway, we've soft-launched my new publication, $10 Trigger Alert. It seems to be going well. The stocks are going up. What nice change from natural resources.

That doesn't mean gold, silver, oil & gas, and other natural resources still don't interest me. Of course they do. Here are some things I find interesting ...

#1: Gold miners' reserves pricing assumes big rally ahead

#1: Gold miners' reserves pricing assumes big rally ahead

From the story:

According to a survey by consulting firm PwC for its new Gold, Silver and Copper Price Report 2015, 60% of gold mining companies expect the price of gold to head lower in the next 12 months. That compares to 7% last year.

According to a survey by consulting firm PwC for its new Gold, Silver and Copper Price Report 2015, 60% of gold mining companies expect the price of gold to head lower in the next 12 months. That compares to 7% last year.

Despite this pessimism however, gold miner's longer term assumptions assume a strong recovery in the gold price from today's levels.

When asked what gold price companies are using to determine reserves, the average among respondents was $1,241 per ounce, with a range of between $950 and $1,350. For resources, the average was $1,331 per ounce with a range of between $950 and $1,600.

Note: I have a an interview HERE where I talk about the future haircuts miners are going to have to take, among other things, if the price of gold doesn't go higher soon.

#2: India Back to Being World's Top Gold Consumer

India reclaimed its world’s top gold consumer crown from China as demand for jewelry surged almost 60% in the third quarter of the year, fresh data from the World Gold Council (WGC) shows.

Global demand, however, fell to its lowest in nearly five years as Chinese buying slid by a third and gold jewellery, the biggest single area of consumption, dropped 4% to 534 tonnes.

Overall, India —which had lost his position as the world’s No.1 gold consumer to China in 2011—bought 39% more gold in the run-up to Diwali and the start of the traditional wedding season.

Gold smuggling into India has skyrocketed since the government ratcheted up restrictions and taxes on legitimate imports of the precious metal. According to the council, about 200 tons of gold came through unofficial route last year and a similar quantity is also expected this year.

Note: See how they buried the bad news in the second paragraph? World gold demand has dropped to its lowest level in 5 years. Fu-u-u-u-u-u-u ....

#3. Gold Chart Sure Looks Like It's Going Lower

I made this chart of the GLD, which tracks the percentage movements in gold pretty closely, on Stockcharts this morning. No one has a crystal ball. But it sure looks like gold is consolidating after a breakdown. Such consolidation usually resolves in the direction of the previous move.

How much lower? If you liked gold at, say, $1,000, you're probably going to get a chance to love it again.

I would love to be wrong on this, by the way. By all means, feel free to show me up so bad I make Dennis Gartman look good.

That said, there are plenty other places to make money. I'll give you one example. The fact that oil is folding like an old tent means a lot of opportunities to make money. That's what we're doing in $10 Trigger Alert. And we've also positioned for it in Oxford Resource Explorer. And those picks are doing quite splendidly.

Also remember that nothing goes down forever. Have money ready when the bottom comes.

Wednesday, November 5, 2014

Oil War, Gold Down, Silver Down Even More

Some stuff I'm reading today.

U.S. Returns Fire in Saudi Arabia's Oil War

The U.S. may buy crude (for the Strategic Petroleum Reserve) to offset a price collapse caused by Saudi dumping and support U.S. shale producers. It could also go further, tacking on a tax on Saudi oil, an issue that would at some point go before the world trade council.

BHP Signs Deal to Sell $50 Million of Lightly Processed Crude Without Official Permit.

A major energy company will soon sell U.S. oil abroad without explicit permission from the government, another sign that the decades-old federal ban on crude exports is crumbling.

A major energy company will soon sell U.S. oil abroad without explicit permission from the government, another sign that the decades-old federal ban on crude exports is crumbling.

BHP Billiton’s deal to sell about $50 million of ultralight oil from Texas to foreign buyers without formal government approval is likely to be only the first of many such moves as energy companies seek new markets and higher prices for the surge of crude now pumped in the U.S.

People in the industry said the U.S. Commerce Department, which oversees oil exports, has been encouraging companies to pursue independent exports without having to issue new rulings permitting it, a process being called “self-classification.”

The department didn’t respond to requests for comment. Department officials have maintained that there has been no change to U.S. oil-export policies.

Refiners and other buyers of light oil across Asia are interested in American condensate so they can diversify their supply from the Mideast.

Silver Falls 5% to a New 4.5-Year Low. Gold Breaks Support

Gold sunk below $1,150 per ounce on Wednesday to its lowest since mid-2010, opening the way for a fall to $1,000 as a surging dollar and stronger share prices weaken the investment case for non-yielding bullion.

Silver fell even harder to hit its cheapest since February 2010 at just above $15 an ounce.

No. 1 gold ETF sees biggest monthly outflow this year in October

The world's largest gold-backed exchange-traded fund, New York's SPDR Gold Shares, saw an outflow of over $1 billion of metal last month as investors lightened holdings in anticipation of a further price drop from current four-year lows.

U.S. Returns Fire in Saudi Arabia's Oil War

The U.S. may buy crude (for the Strategic Petroleum Reserve) to offset a price collapse caused by Saudi dumping and support U.S. shale producers. It could also go further, tacking on a tax on Saudi oil, an issue that would at some point go before the world trade council.

BHP Signs Deal to Sell $50 Million of Lightly Processed Crude Without Official Permit.

A major energy company will soon sell U.S. oil abroad without explicit permission from the government, another sign that the decades-old federal ban on crude exports is crumbling.

A major energy company will soon sell U.S. oil abroad without explicit permission from the government, another sign that the decades-old federal ban on crude exports is crumbling.BHP Billiton’s deal to sell about $50 million of ultralight oil from Texas to foreign buyers without formal government approval is likely to be only the first of many such moves as energy companies seek new markets and higher prices for the surge of crude now pumped in the U.S.

People in the industry said the U.S. Commerce Department, which oversees oil exports, has been encouraging companies to pursue independent exports without having to issue new rulings permitting it, a process being called “self-classification.”

The department didn’t respond to requests for comment. Department officials have maintained that there has been no change to U.S. oil-export policies.

Refiners and other buyers of light oil across Asia are interested in American condensate so they can diversify their supply from the Mideast.

Silver Falls 5% to a New 4.5-Year Low. Gold Breaks Support

Gold sunk below $1,150 per ounce on Wednesday to its lowest since mid-2010, opening the way for a fall to $1,000 as a surging dollar and stronger share prices weaken the investment case for non-yielding bullion.

Silver fell even harder to hit its cheapest since February 2010 at just above $15 an ounce.

No. 1 gold ETF sees biggest monthly outflow this year in October

The world's largest gold-backed exchange-traded fund, New York's SPDR Gold Shares, saw an outflow of over $1 billion of metal last month as investors lightened holdings in anticipation of a further price drop from current four-year lows.

Tuesday, November 4, 2014

Your Must-See Oil Chart of the Day

The Saudis lowered their oil prices again, and West Texas Intermediate Crude (the US benchmark) for December delivery fell $1.95 to $76.83 a barrel this morning. Intraday, that's a three-year low. And last night's close was the lowest close since August 2nd 2010. Let's look at a chart ...

(Update chart)

Morgan Stanley estimates the average breakeven oil price for these US plays to be around $76-$77 per barrel. Goldman Sachs puts that number at closer to $75. Read that story HERE.

Here are some useful stories I've written on oil recently.

3 Things You Must Know About Oil Prices. Published on October 17th, this one is on target.

Nice Oil Cartel You Got There. Be a Shame if Something Happened to It. Published on October 16th, this explains why the Saudis are thumbing their nose at the rest of OPEC.

The Energy Sector Says 'Merry Christmas'. Published on October 23rd, this explains what kind of stocks you should be buying now.

We've seen this coming. We've positioned for it. You should be positioned for it, too.

(Update chart)

Morgan Stanley estimates the average breakeven oil price for these US plays to be around $76-$77 per barrel. Goldman Sachs puts that number at closer to $75. Read that story HERE.

Here are some useful stories I've written on oil recently.

3 Things You Must Know About Oil Prices. Published on October 17th, this one is on target.

Nice Oil Cartel You Got There. Be a Shame if Something Happened to It. Published on October 16th, this explains why the Saudis are thumbing their nose at the rest of OPEC.

The Energy Sector Says 'Merry Christmas'. Published on October 23rd, this explains what kind of stocks you should be buying now.

We've seen this coming. We've positioned for it. You should be positioned for it, too.

Thursday, October 30, 2014

Here's Where it Gets Tricky: Russell 2000 ($IWM) at Overhead Resistance

Here's an update of a chart I originally posted October 11th. Check out this chart from StockCharts.com for IWM. You can see that it has recovered from broken price support, but now it is testing its broken uptrend line. This would be a classic place for it to roll over.

Stocks look ready to sell off this morning, as investors worry about a more "hawkish" Federal Reserve. And we may see the small-caps sell off more than most. But is it another fake-out or the real deal?

The metrics on the economy are improving. And I'm not just talking about the advance Q3 GDP, which came in at 3.5%, beating expectations of 3% growth.

Still, the U.S. dollar surged to a 6-week high yesterday, on the hawkish Fed news that shouldn't have surprised anybody. And gold took it in the chops.

Gold is weaker because it is priced in dollars. But you know what also is priced in dollars? The stock market! Just as a weaker currency can send stocks higher, a stronger currency can send stocks lower.

My gut feeling is that the sell-off in stocks that we saw yesterday -- and may see continue today -- is just a trade of the moment that lacks fundamental backing to support it. Inflation is heading lower in the near term and earnings growth is headed higher. Sure, the Fed is no longer as strong an ally to stocks as it once was. But that's because it no longer has to be.

I'd like to see how this week ends before putting more money to work. Good luck and good trades.

Stocks look ready to sell off this morning, as investors worry about a more "hawkish" Federal Reserve. And we may see the small-caps sell off more than most. But is it another fake-out or the real deal?

The metrics on the economy are improving. And I'm not just talking about the advance Q3 GDP, which came in at 3.5%, beating expectations of 3% growth.

Still, the U.S. dollar surged to a 6-week high yesterday, on the hawkish Fed news that shouldn't have surprised anybody. And gold took it in the chops.

Gold is weaker because it is priced in dollars. But you know what also is priced in dollars? The stock market! Just as a weaker currency can send stocks higher, a stronger currency can send stocks lower.

My gut feeling is that the sell-off in stocks that we saw yesterday -- and may see continue today -- is just a trade of the moment that lacks fundamental backing to support it. Inflation is heading lower in the near term and earnings growth is headed higher. Sure, the Fed is no longer as strong an ally to stocks as it once was. But that's because it no longer has to be.

I'd like to see how this week ends before putting more money to work. Good luck and good trades.

Wednesday, October 29, 2014

Must See Charts on Solar, Recession Triggers and Gold Miners

Here are some charts and stories you need to read.

While You Were Getting Worked Up Over Oil Prices, This Just Happened to Solar

After years of struggling against cheap natural gas prices and variable subsidies, solar electricity is on track to be as cheap or cheaper than average electricity-bill prices in 47 U.S. states -- in 2016, according to a Deutsche Bank report published this week.

Solar has already reached grid parity in 10 states that are responsible for 90 percent of U.S. solar electricity production. In those states alone, installed capacity growth will increase as much as sixfold over the next three to four years.

The chart below shows the price of energy sources since the late 1940s. The extreme outlier, of course, is solar, which only recently became an expensive blip in the energy marketplace. It will soon undercut even the cheapest fossil fuels in many regions of the planet, including poorer nations where billion-dollar coal plants aren’t always practical.

Solar will be the world’s biggest single source of energy by 2050.

Projects Canceled as Oil Price Drops

The drop in oil prices has led to about 22 projects being canceled this year, principally in Canada and the Arctic. Still, traders are betting on a big rebound in the oil price. OPEC next meets on November 27th.

Morgan Stanley: Freight Cycle Favors Shippers Over Truckers

Barge capacity and rail capacity are set to expand the most according to a recent note from Morgan Stanley.

ROSENBERG: Bear Markets Don't Just Happen — They're Caused By These Two Conditions.

"The reality is that bear markets do not just pop out of the air," he wrote. "They are caused by tight money, recessions, or both. These conditions do not apply, nor will they until 2016 at the earliest."

Based on the trends in the Conference Board's Leading Economic Index, a recession is "at least two years away," Rosenberg said. "That is one peg — the expansion being sustained. The other is the Fed policy, and any actual rate hikes now seem to be more of a 2015 than a 2016 story."

Worst Chart of the Day: Gold Miners

Read it and weep ...

(Updated chart)

Some stories on the yellow metal ...

No Love for Gold: Holdings in gold-backed exchange-traded products fell 1.8 metric tons to 1,652.1 tons yesterday, remaining at a five-year low. And sentiment in the gold markets is terrible and getting worse, says Mark Hulbert.

On the other hand, demand for gold in India is surging as festival season gets underway.In September alone, India imported $3.75 billion worth of gold, a 450 per cent jump from year-ago levels. And Russia's state gold reserves are at their highest level in two decades. And despite slowing down, the Chinese seem to be buying a lot of gold.

While You Were Getting Worked Up Over Oil Prices, This Just Happened to Solar

After years of struggling against cheap natural gas prices and variable subsidies, solar electricity is on track to be as cheap or cheaper than average electricity-bill prices in 47 U.S. states -- in 2016, according to a Deutsche Bank report published this week.

Solar has already reached grid parity in 10 states that are responsible for 90 percent of U.S. solar electricity production. In those states alone, installed capacity growth will increase as much as sixfold over the next three to four years.

The chart below shows the price of energy sources since the late 1940s. The extreme outlier, of course, is solar, which only recently became an expensive blip in the energy marketplace. It will soon undercut even the cheapest fossil fuels in many regions of the planet, including poorer nations where billion-dollar coal plants aren’t always practical.

Solar will be the world’s biggest single source of energy by 2050.

Projects Canceled as Oil Price Drops

The drop in oil prices has led to about 22 projects being canceled this year, principally in Canada and the Arctic. Still, traders are betting on a big rebound in the oil price. OPEC next meets on November 27th.

Morgan Stanley: Freight Cycle Favors Shippers Over Truckers

Barge capacity and rail capacity are set to expand the most according to a recent note from Morgan Stanley.

ROSENBERG: Bear Markets Don't Just Happen — They're Caused By These Two Conditions.

"The reality is that bear markets do not just pop out of the air," he wrote. "They are caused by tight money, recessions, or both. These conditions do not apply, nor will they until 2016 at the earliest."

Based on the trends in the Conference Board's Leading Economic Index, a recession is "at least two years away," Rosenberg said. "That is one peg — the expansion being sustained. The other is the Fed policy, and any actual rate hikes now seem to be more of a 2015 than a 2016 story."

Worst Chart of the Day: Gold Miners

Read it and weep ...

(Updated chart)

Some stories on the yellow metal ...

No Love for Gold: Holdings in gold-backed exchange-traded products fell 1.8 metric tons to 1,652.1 tons yesterday, remaining at a five-year low. And sentiment in the gold markets is terrible and getting worse, says Mark Hulbert.

On the other hand, demand for gold in India is surging as festival season gets underway.In September alone, India imported $3.75 billion worth of gold, a 450 per cent jump from year-ago levels. And Russia's state gold reserves are at their highest level in two decades. And despite slowing down, the Chinese seem to be buying a lot of gold.

Subscribe to:

Posts (Atom)